Projects

A K M Rokonuzzaman Sonet — Ph.D. Candidate in Financial Mathematics, Florida State University

Auto-Loan Credit Decision Model

Classification of loan defaults using Logistic Regression, Random Forest, XGBoost, SMOTE, SHAP explainability.

Stock Price Prediction using LSTM

Time series forecasting of stock prices with LSTM neural networks and financial data preprocessing.

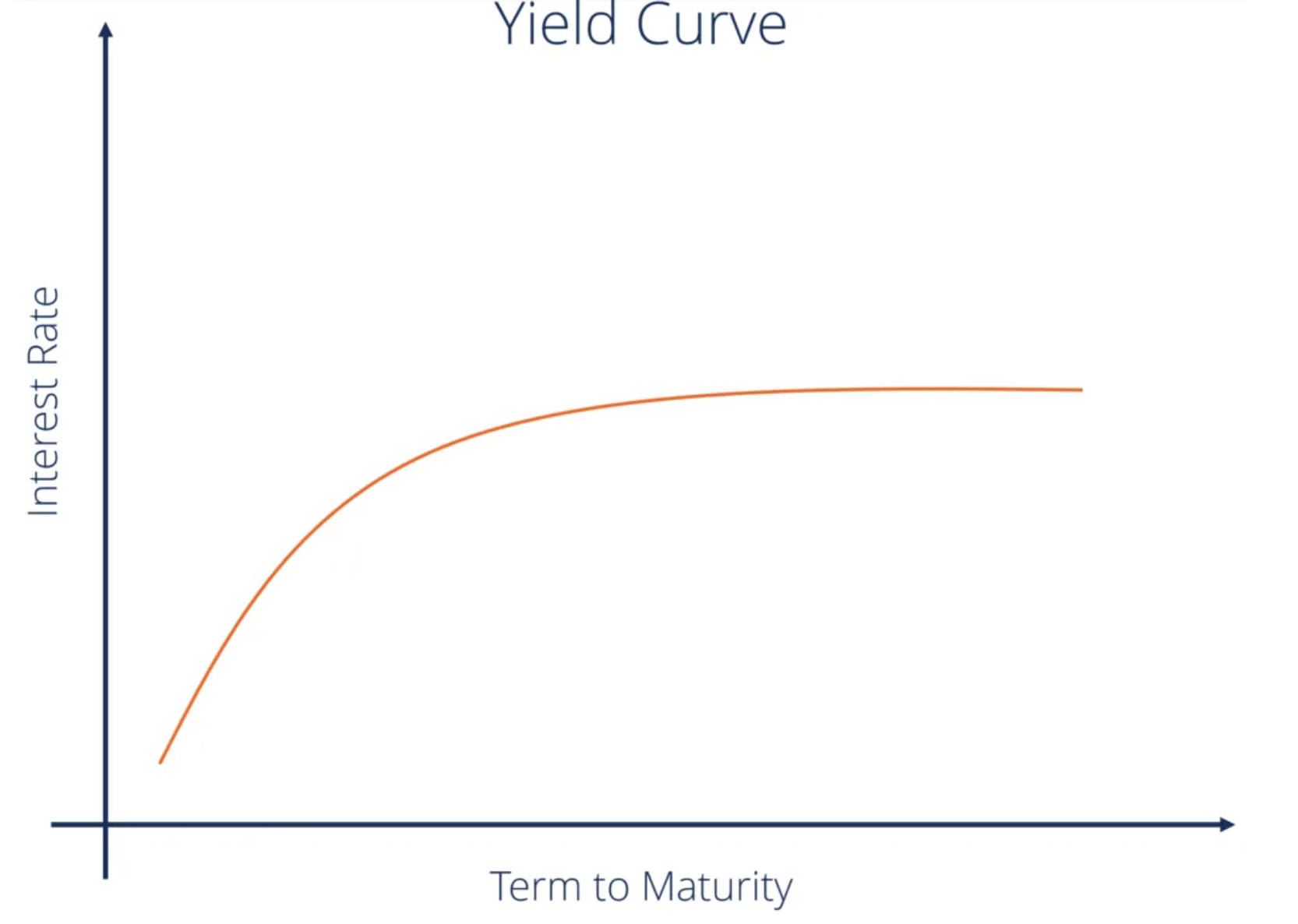

Interest Rate Model

Implementation of Hull–White model for pricing ZCB options, compared with Black-76 using different yield curve constructions.

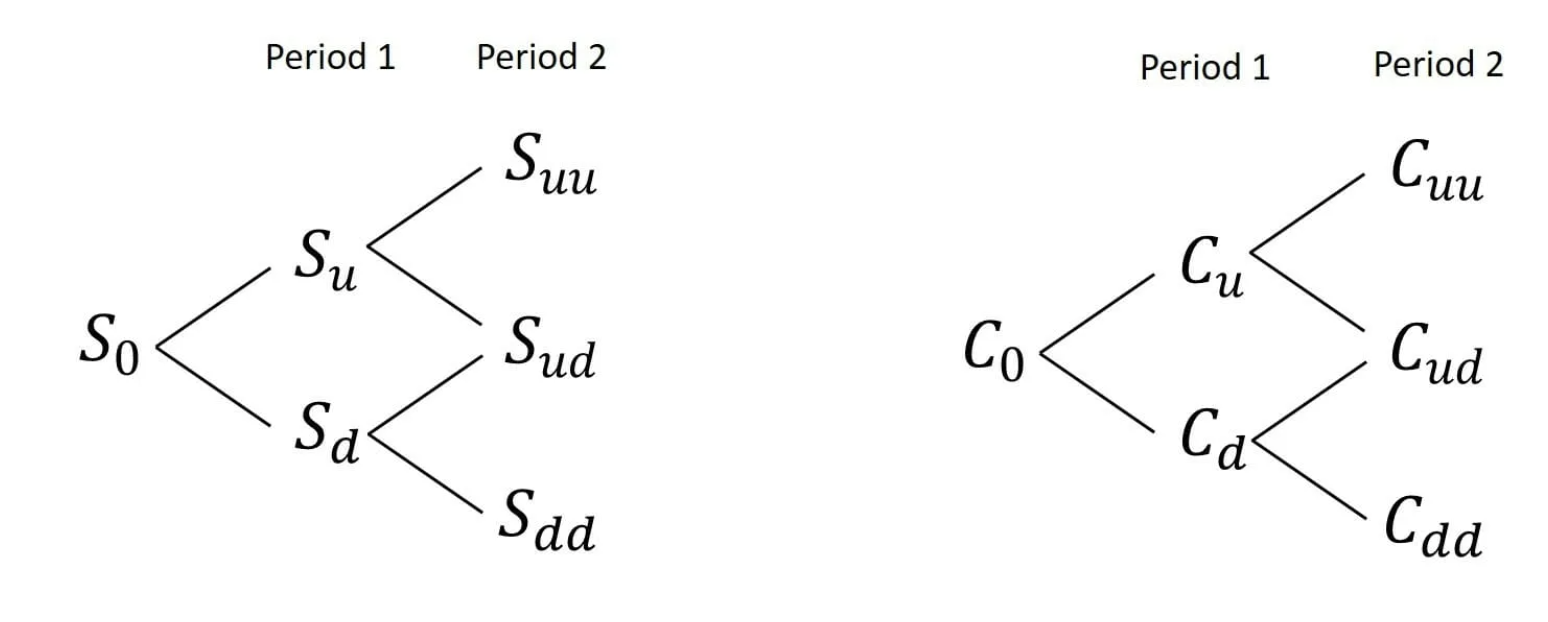

American Options Pricing

Pricing using CRR Binomial Tree, Trinomial Tree, Least-Squares Monte Carlo (LSM), and Finite Difference Method.

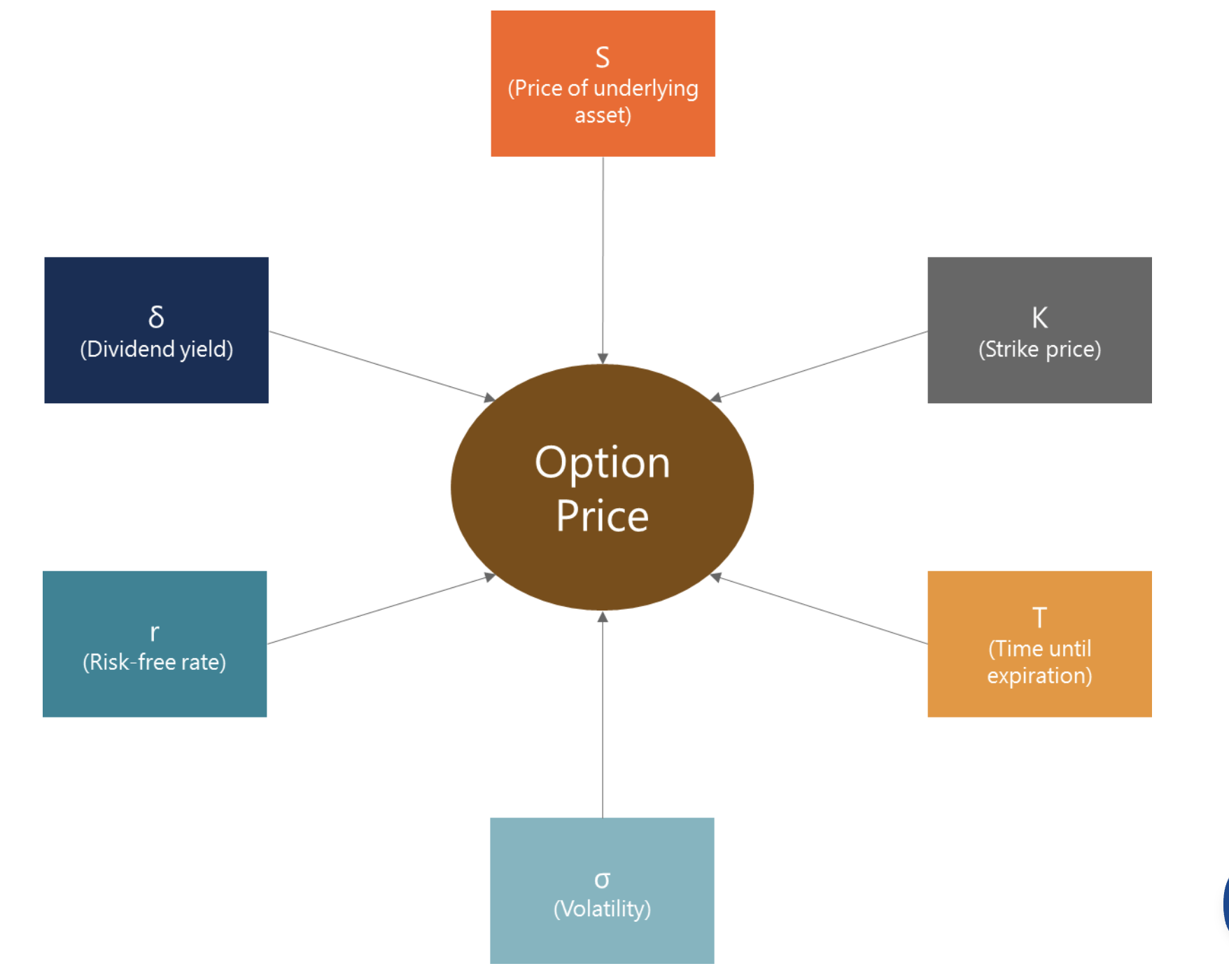

European Options Pricing

Black–Scholes pricing engine with Monte Carlo simulations and Greeks estimation.

Delta Hedging (Constant & Stochastic Volatility)

Dynamic hedging simulator under Black–Scholes, Heston, and GARCH models, with transaction cost analysis.