A K M Rokonuzzaman Sonet

I am a Ph.D. candidate in Financial Mathematics at Florida State University with expertise in quantitative finance, Monte Carlo methods, stochastic optimization, and machine learning. Working with Dr. Lingjiong Zhu, my research investigates the emergence of heavy tails in stochastic gradient methods, particularly SGD with momentum and Decentralized SGD. My applied projects span option pricing, credit risk modeling, interest rate modeling, and deep learning for financial prediction. I am passionate about leveraging advanced quantitative techniques and data-driven methods to drive innovation in quantitative research, model development, and financial solutions.

Contact

Download my CV: Sonet_Curriculum_Vitae.pdf

Research Interests

- Optimization and Machine Learning Theory

- Algorithmic Stability and Generalization

- Data Science

- Computational Finance and Derivatives Pricing

- Financial Risk Management

Details on the Research page.

Selected Projects

Auto-Loan Credit Decision Model

Classification of loan defaults using Logistic Regression, Random Forest, XGBoost, SMOTE, SHAP explainability.

Stock Price Prediction using LSTM

Time series forecasting of stock prices with LSTM neural networks and financial data preprocessing.

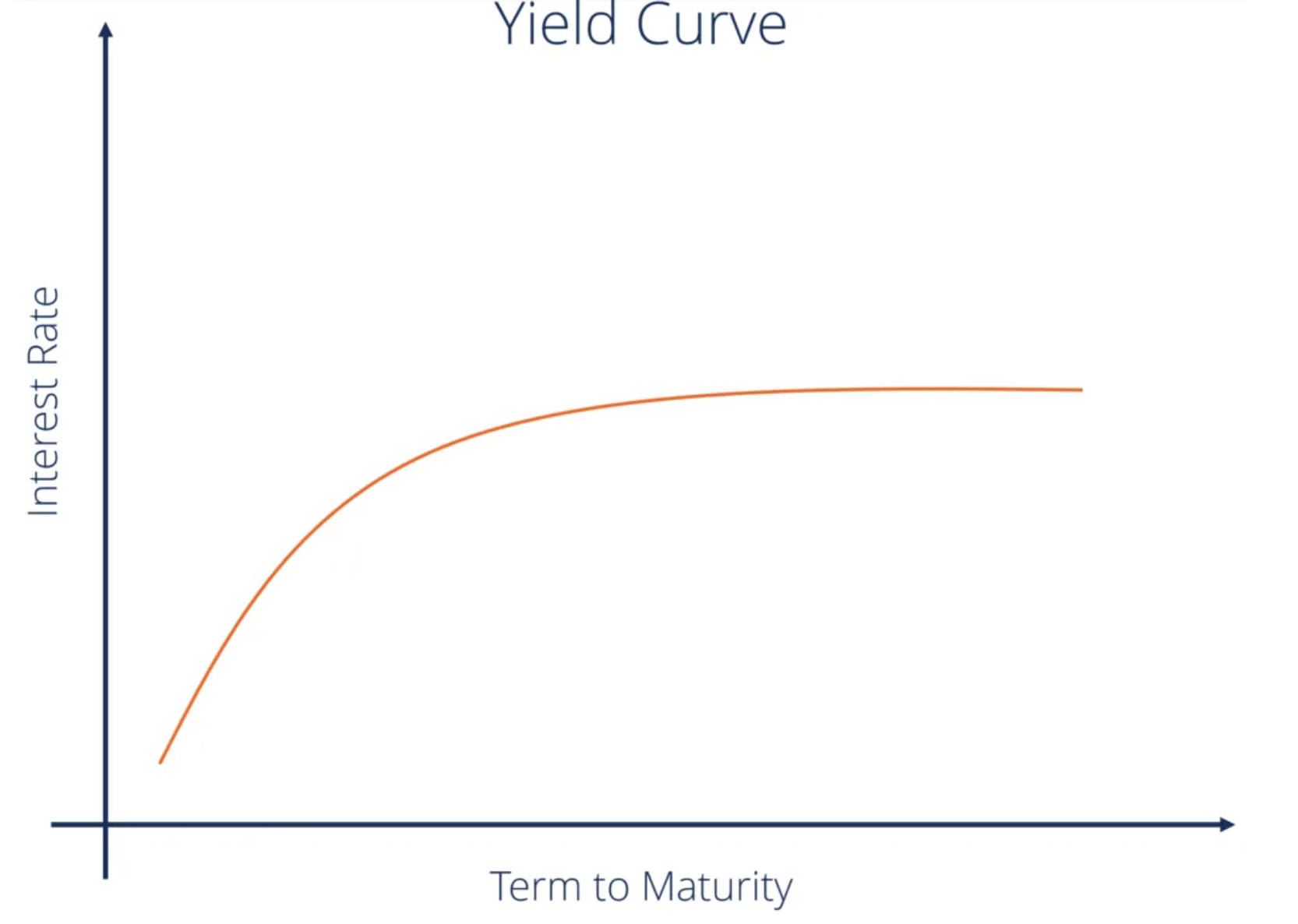

Interest Rate Model

Implementation of Hull–White model for pricing ZCB options, compared with Black-76 using different yield curve constructions.

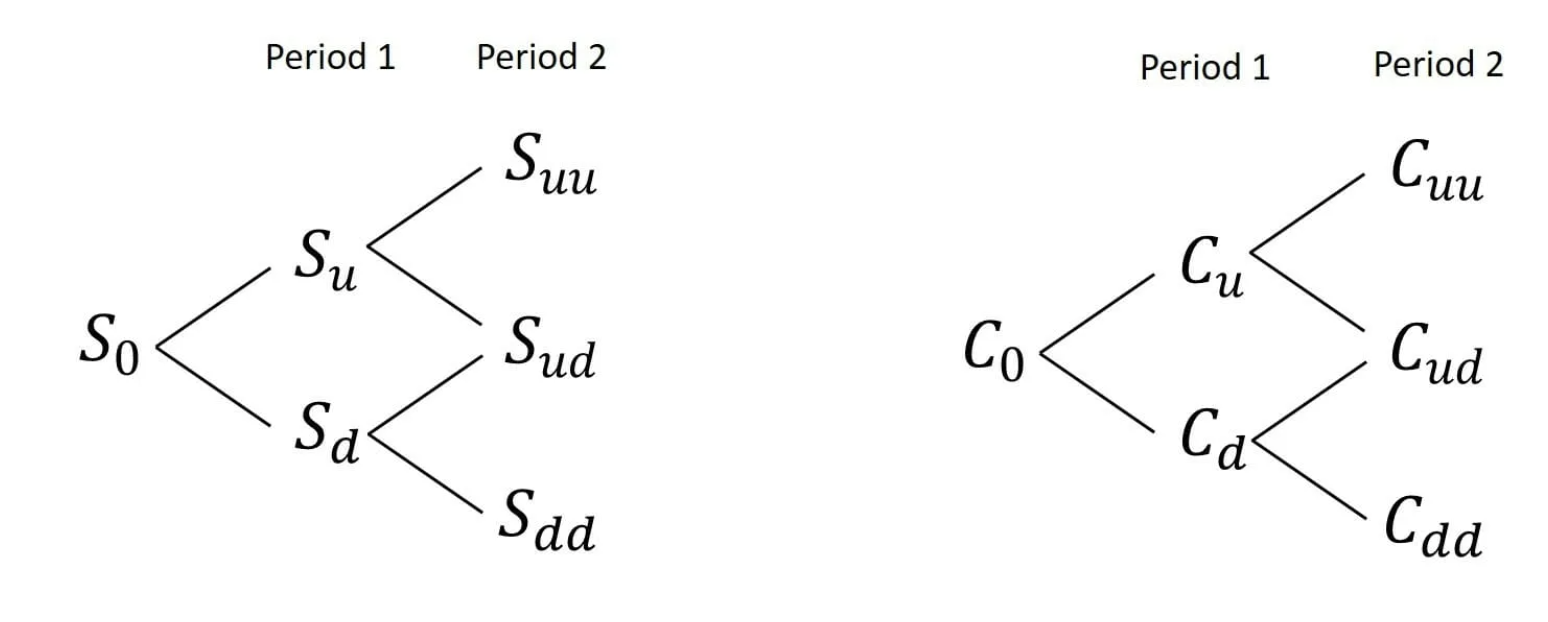

American Options Pricing

Pricing using CRR Binomial Tree, Trinomial Tree, Least-Squares Monte Carlo (LSM), and Finite Difference Method.

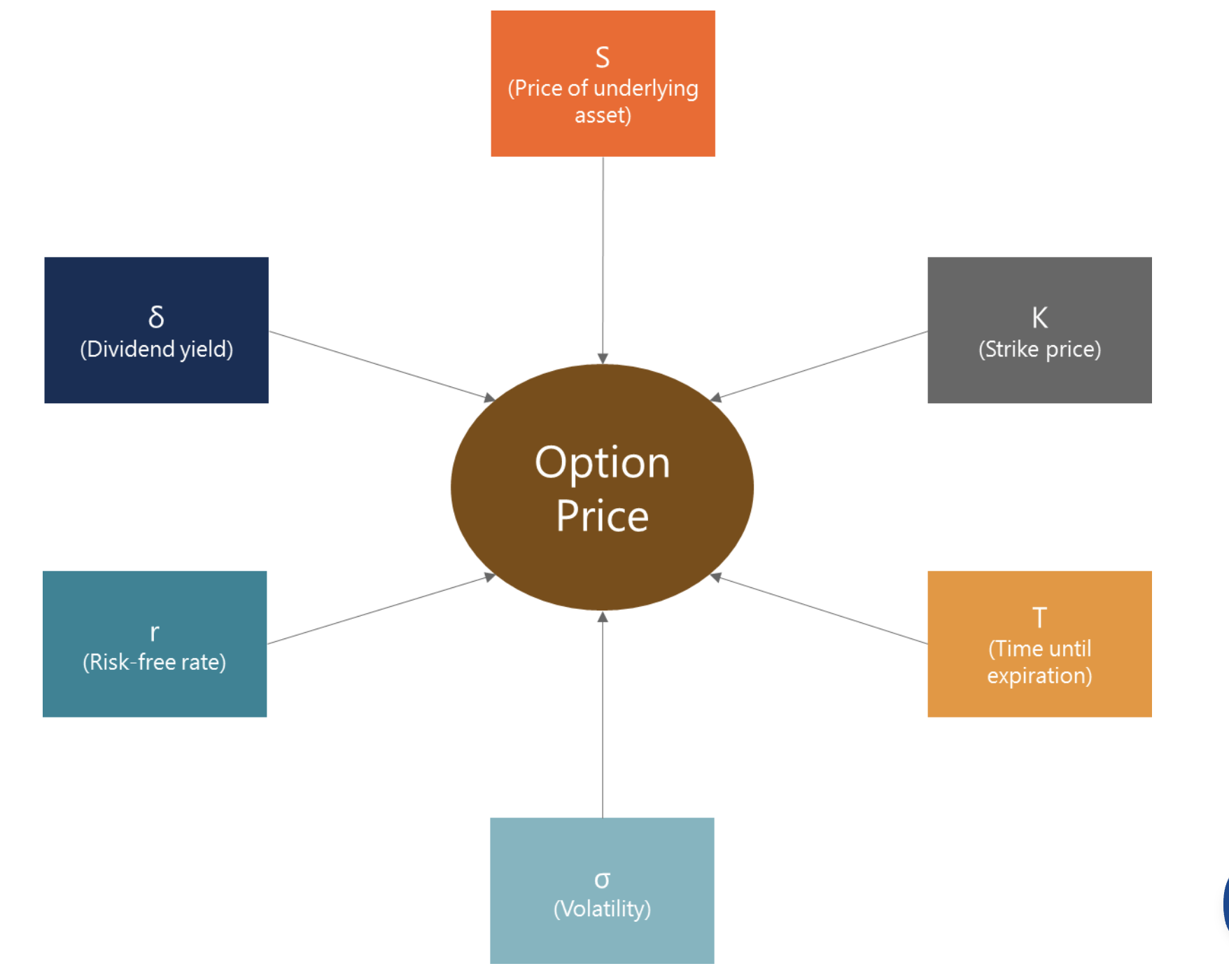

European Options Pricing

Black–Scholes pricing engine with Monte Carlo simulations and Greeks estimation.

Delta Hedging (Constant & Stochastic Volatility)

Dynamic hedging simulator under Black–Scholes, Heston, and GARCH models, with transaction cost analysis.

See more on the Projects page.